The nation has additionally initiated negotiations to safe a brand new IMF mortgage bundle of $6-8 billion for 3 years after the completion of the present one in April 2024.

Moreover, the disaster within the Center East has the potential to trigger a spike in power costs in world markets. This will likely result in a resurgence of imported inflation within the nation, nullifying the latest efforts to decelerate inflation via sustaining a decent financial coverage for over three years now.

It’s anticipated that the inflation fee will lower to round 17% for April 2024 from 20.7% within the earlier month of March, having peaked at 38% in Might 2023. Consequently, the true rate of interest turned optimistic in March by 1.3 proportion factors, with additional enchancment anticipated in April.

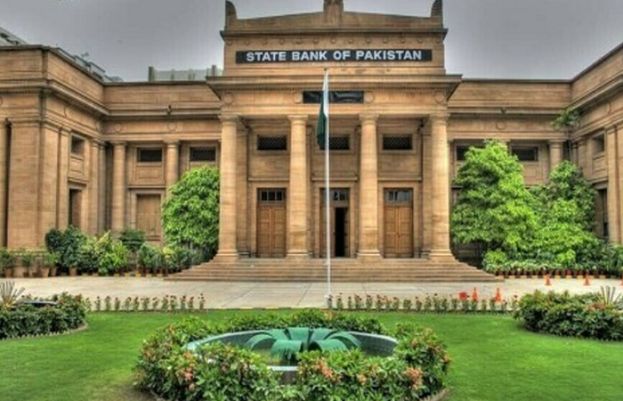

“The MPC (financial coverage committee) noticed that the extent of inflation stays excessive. Concurrently, world commodity costs appear to have bottomed out amidst resilient world progress. Current geopolitical occasions have additionally launched uncertainty relating to their outlook. Moreover, upcoming budgetary measures might affect the near-term inflation outlook,” State Financial institution of Pakistan (SBP) said in its financial coverage assertion

Since its final assembly held in mid-March 2024, the MPC famous key developments. First, knowledge for the primary half of FY24 means that financial exercise is recovering at a average tempo, led by a robust rebound within the agriculture sector.

Second, the present account recorded a major surplus in March 2024, which helped to stabilise the SBP’s overseas trade reserves regardless of substantial debt repayments and weak monetary inflows.

Third, inflation expectations of customers elevated barely in April 2024, whereas these for companies declined. Lastly, main central banks, significantly in superior economies, have adopted a cautious coverage stance after noticing some slowdown within the tempo of disinflation in latest months.

Incoming knowledge continues to help the MPC’s earlier expectation of a average restoration on this fiscal 12 months, with actual GDP progress projected to stay within the vary of two to three%.

The agriculture sector stays the important thing driver, with sturdy progress of 6.8% within the first half of FY24, supported by a major enhance in rice, cotton, maize, and wheat harvests, based on the most recent official estimates.

Within the industrial sector, large-scale manufacturing reported a 0.5% decline in July-February FY24 in comparison with a 4% contraction recorded in the identical interval final 12 months.

Concerning the companies sector, the committee famous that progress within the first half of the 12 months was barely decrease than anticipated, reflecting the affect of subdued demand.

Based mostly on comparatively improved capability utilisation and enterprise sentiments, in addition to a low base impact from final 12 months, the MPC expects worth addition from the manufacturing and companies sectors to recuperate within the coming months.